Oct 1 2009

Strong LCD TV shipment growth during the second quarter in key markets like China and North America and the prospect for continuing growth during the remainder of the year have led DisplaySearch to increase its 2009 global LCD TV shipment forecast to 130M units from 127M units previously, for an annual growth of 24%. The forecast for TV shipments of all display technologies in 2009 was reduced from the previous forecast by 3% to 195M units for a 5% shipment decline from 2008, as the market for traditional CRT TVs is declining faster than previously expected and the growth in flat panel TVs is not strong enough to fully compensate.

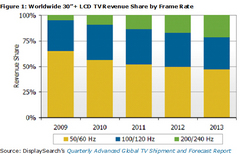

Worldwide 30" LCD TV Revenue Share by Frame Rate

Worldwide 30" LCD TV Revenue Share by Frame Rate

"The transition from CRT-based TVs to flat panel TVs is largely complete in developed regions worldwide, like North America, Western Europe and Japan," noted Hisakazu Torii, Vice President of TV Research at DisplaySearch. "Now the transition to flat is accelerating in emerging markets like China, and we are seeing sales of CRT TVs fall faster than flat panel TVs can grow, mostly due to supply constraints in LCD TV."

The global economic recession has also had an impact on purchases of TVs. Consumers still want to purchase flat panel TVs, but they are trimming their budgets and setting their sights a little lower in terms of size and price. Therefore, a large majority of the increased shipment forecast for LCD TVs in 2009 is in smaller sizes, below 40". As a result, the average LCD TV screen size will be nearly unchanged in 2009 compared with 2008, after 4% growth last year. Average sizes will resume growing in 2010 but at a slower rate than in recent years.

LCD TVs Remain Resilient

The increase in global LCD TV shipment expectations for the remainder of 2009 and beyond is a positive trend for the industry. Even so, the price of LCD panels used in TVs has been rising sharply in recent months, effectively increasing the cost of producing LCD TVs. Despite this, LCD TV average selling prices continue to erode by an expected 22% Y/Y in 2009. Combined with rising panel costs, the continued price erosion will have a negative impact on profit margins at many points in the supply chain. DisplaySearch is still forecasting a revenue decline in 2009, although it has been reduced to a 3% drop from 6% previously, due to the increase in expected unit shipments.

"The 2009 US holiday season will be a critical measure of how confident consumers are with the economic recovery, and how far brands and retailers are willing to go in order to drive store traffic," observed Paul Gagnon, Director of North America TV Research for DisplaySearch. "We expect unit shipments to outpace the weak results from a year ago, but it will take aggressive promotional prices from major brands and retailers alike to bring consumers into stores, especially for larger screen sizes, something that is even more challenging considering key costs have drifted higher in recent months."

DisplaySearch increased its North America LCD TV shipment forecast from just over 31M units to 34M units, with all of the increased volume coming from smaller than 40" screen sizes.

The large-screen portion of the LCD TV market, defined as 40"+, is expected to grow 25% Y/Y in 2009, which is about half the pace of 2008 growth. By contrast, the <40" LCD TV shipment volume is expected to grow 23% in 2009, similar to 2008 growth levels.

"This is a clear result of the lower spending power by consumers worldwide in this recession, pushing them to look at more modest screen sizes when choosing a new LCD TV," noted Gagnon. "However, we think this is a temporary effect; as the world emerges from the recession in 2010 and beyond, growth rates for large screen sizes will again outpace smaller sizes by a more substantial margin."

DisplaySearch also now tracks shipments of 100/120 Hz and 200/240 Hz frame rate LCD TVs. Higher frame rates are important to manufacturers and retailers who seek to mitigate the commoditization of LCD TVs with high performance features. 100/120 Hz frame rate models will account for 31% of LCD TV revenues worldwide in 2009 while 200/240 Hz will take about 5% of revenues. By 2013, 100/120 Hz will account for 32% of LCD TV revenues, while 200/240 Hz will account for nearly 22% (Figure 1.).

The DisplaySearch Q3'09 Quarterly Advanced Global TV Shipment and Forecast Report includes panel and TV shipments by region and by size for nearly 60 brands, and also includes rolling 16-quarter forecasts, TV cost/price forecasts and design wins. Beginning in Q1'09 the report also now provides detail on 60/120/240 Hz LCD TV frame rates by size and resolution, including TV cost modeling for both 60 Hz and 120 Hz sets. This report is delivered in PowerPoint and includes Excel pivot tables. If you need further information or assistance please contact us at +1.512.687.1511 or sales(AT)displaysearch.com or at the local DisplaySearch offices in China, Japan, Korea, Taiwan and the United Kingdom.