The steel industry's journey toward carbon neutrality has gained momentum, with hydrogen-based and electric ironmaking technologies advancing more rapidly in recent years than before. These innovations create a pathway to truly sustainable "green steel" production.

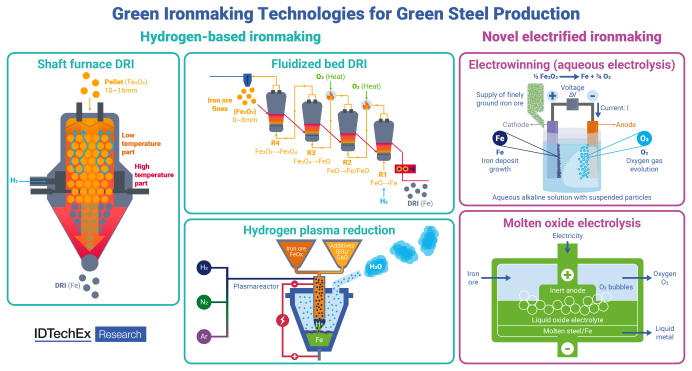

Key hydrogen and electric ironmaking technologies for green steel production. Image Credit: IDTechEx

Key hydrogen and electric ironmaking technologies for green steel production. Image Credit: IDTechEx

Major steelmakers, mining conglomerates, and metallurgical technology providers are actively developing proprietary technologies and strategically investing in emerging steel companies. Their focus has particularly sharpened on novel hydrogen and electric ironmaking processes. This represents a deliberate diversification strategy that extends beyond conventional electric arc furnace (EAF) steelmaking, addressing the fundamental challenge of emission-intensive blast furnaces. These established players are positioning themselves to maintain competitive advantages in an increasingly carbon-constrained market by broadening their technological portfolios.

According to IDTechEx forecasts, hydrogen-based green steel production is expected to reach 46 million tonnes by 2035. Comprehensive information on key green steel technologies and industry players can be found in IDTechEx's new report, "Green Steel 2025-2035: Technologies, Players, Markets, Forecasts"

Hydrogen-Based DRI: Leading the Transition Despite Challenges

Direct reduced iron (DRI) production using shaft furnaces with natural gas as the reductant has already gained widespread adoption globally. The Middle East leads in adoption and production due to abundant, low-cost natural gas, followed by North America and North Africa. India also maintains a significant DRI production base, though primarily relying on coal-based DRI using rotary kilns.

Hydrogen-based DRI (H2-DRI) processes represent the next logical evolution toward greener steel production, making them the most sought-after technology for current green steel projects. Midrex and Energiron shaft furnace plants have successfully demonstrated the use of hydrogen or hydrogen-rich gases, as evidenced in projects like HYBRIT by SSAB in Sweden and HBIS Group in China.

Europe leads in planned green steel projects, with substantial activity in the Middle East, the US, and China. However, most of these projects - with notable exceptions such as Stegra's Boden plant - will likely begin operations using natural gas before transitioning to low-carbon hydrogen. The timeline for these transitions depends heavily on the availability of green and blue hydrogen and supporting infrastructure.

This represents the major challenge facing the green steel transition - steelmakers require low-carbon hydrogen in large quantities for US$2-3/kg, significantly lower than the current US$4-8/kg for green hydrogen. This economic reality has prompted companies to reconsider their green steel projects, most notably ArcelorMittal deferring final investment decisions (FIDs) despite securing nearly €3 billion in EU subsidies. The expansion and cost reduction of low-carbon hydrogen infrastructure around industrial clusters will, therefore, be crucial for DRI sites to adopt hydrogen at scale.

Alternative Hydrogen-Based Technologies are Gaining Momentum

Alternatives to conventional H2-DRI in shaft furnaces primarily revolve around fluidized bed DRI reactors or hydrogen smelting plasma reduction (HSPR). Fluidized bed H2-DRI technology has been in development for years, with several small industrial-scale demonstration plants operating worldwide. Companies including POSCO, Voestalpine, and Metso Outotec, are actively developing concepts in this space.

The primary advantage of fluidized bed H2-DRI is its ability to directly use low-grade iron ore fines, unlike shaft furnaces, which require high-quality pellets as feedstock. However, these technologies still face significant hurdles in commercial scale-up and adoption.

HSPR offers a novel alternative that utilizes iron ore fines while coupling simultaneous reduction and smelting to produce molten pig iron directly. This eliminates the need for a separate electric arc furnace (EAF) as required in DRI plants. HSPR can potentially reduce hydrogen consumption and offer partial electrification through high-temperature plasma technology. Development is currently led by Voestalpine and K1-MET, with several startups planning to enter the space. However, this technology remains at a much earlier stage of technological readiness compared to fluidized bed DRI.

Electric Ironmaking Technologies are in the Spotlight for Innovation

Electric ironmaking technologies eliminate the need for hydrogen as a reducing agent through electrolysis of iron ore. Several approaches are under development worldwide. Most notably, US-based startup Boston Metal is pioneering molten oxide electrolysis (MOE), while another US startup, Electra, is developing an electrowinning approach combining aqueous-phase electrolysis and electroplating.

These companies have secured substantial funding from prominent investors including Breakthrough Energy Ventures, BHP, ArcelorMittal, and various other players from the mining, steel, and venture capital sectors. Many industry observers consider these technologies potentially disruptive, as they can entirely bypass hydrogen requirements and integrate seamlessly with existing steel mills. However, the companies developing these solutions still face many years of work to scale their technologies and achieve cost competitiveness.

Other Novel Technologies and Further Insights

Numerous companies and research institutes are developing hybrid approaches to iron ore reduction. These include Rio Tinto's BioIron, which combines microwave energy with biomass as a reducing agent, and electrified heating approaches such as Calix's ZESTY process, which utilizes an electrically heated hydrogen-based shaft furnace.

IDTechEx anticipates that while many technologies will emerge in the market, only those addressing the steel industry's core challenges while achieving cost parity with conventional natural gas-based DRI, EAF steelmaking, and blast furnace-based production will ultimately succeed.

While steel decarbonization shows promising developments, the industry continues to face substantial challenges and will remain dependent on coal-based blast furnace infrastructure for years to come. Despite these obstacles, IDTechEx projects hydrogen-based green steel production to reach 46 million tonnes by 2035 - a significant number, though still insufficient to meet 2050 net-zero targets.