Jul 22 2009

With the increasing global customer base, food retailing is transforming. However, with the move toward globalization, food packaging requires longer shelf life, along with monitoring food safety and quality based upon international standards. To address these needs, nanotechnology is enabling new food and beverage packaging technologies.

Applications in nano-enabled packaging span development of improved tastes, color, flavor, texture and consistency of foodstuffs, increased absorption and bio-availability of nutrients and health supplements, new food packaging materials with improved mechanical, barrier and antimicrobial properties, and nano-sensors for traceability and monitoring the condition of food during transport and storage.

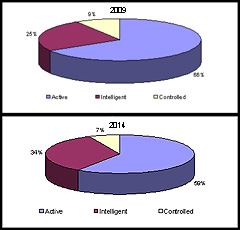

According to a latest study from iRAP, Inc., Nano-Enabled Packaging for the Food and Beverage Industry - A Global Technology, Industry and Market Analysis, the total nano-enabled food and beverage packaging market in the year 2008 was $4.13 billion, which is expected to grow in 2009 to $4.21 billion and forecasted to grow to $7.30 billion by 2014, at a CAGR of 11.65%. Active technology represents the largest share of the market, and will continue to do so in 2014, with $4.35 billion in sales, and the intelligent segment will grow to $2.47 billion sales.

Other highlights of the study are as follows:

- Among active technologies, oxygen scavenger, moisture absorbers and barrier packaging represent more than 80% of the current market.

- Time/temperature indicators are a major share of intelligent packaging, with radio frequency identification data tags (RFIDs) forecasted to show the strongest growth in this category in the future.

- In food products, the bakery and meat products categories have attracted the most nano-packaging applications, and in beverages, carbonated drinks and bottled water dominate.

- Among the regions, Asia/Pacific, in particular Japan, is the market leader in active nano-enabled packaging, with 45% of the current market, valued at $1.86 billion in 2008 and projected to grow to $3.43 billion by 2014, at a CAGR of 12.63%.

- In the United States, Japan, and Australia, active packagings are already being successfully applied to extend shelf-life while maintaining nutritional quality and ensuring microbiological safety. Examples of commercial applications include the use of oxygen scavengers for sliced processed meat, ready-to-eat meals and beer, the use of moisture absorbers for fresh meat, poultry, and fresh fish, and ethylene-scavenging bags for packaging of fruit and vegetables. In Europe, however, only a few of these systems have been developed and are being applied now. The main reasons for this are legislative restrictions and a lack of knowledge about acceptability to European consumers, as well as the efficacy of such systems and the economic and environmental impact such systems may have. The European "Actipak" project will address these issues in the near future.

- Nanoclays have shown the broadest commercial viability due to their lower cost and their utility in common thermoplastics like polypropylene (PP), thermoplastic polyolefin (TPO), PET, polyethylene (PE), polystyrene (PS), and nylon.