May 23 2008

Veeco Instruments Inc., announced that it has extended its thin film solar equipment product line with the acquisition of Mill Lane Engineering, a privately held manufacturer of web coating systems for flexible solar panels. Mill Lane is based in Lowell, MA and has approximately 20 employees. The purchase price was $11 million, paid at closing, plus potential additional payments based upon the satisfaction of specific future conditions, including certain order, sales and profit levels. Mill Lane has an existing multi-unit order for web coating systems from a leading manufacturer of thin film copper indium gallium selenide (CIGS) solar cells.

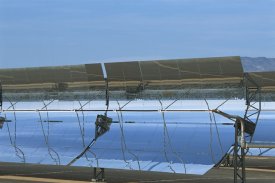

John R. Peeler, Chief Executive Officer of Veeco, commented, “This investment complements Veeco’s existing deposition technologies, expanding our product offerings for the emerging thin film solar market. While many of today’s solar panels are based on silicon technology, thin films offer low manufacturing costs and the promise of higher photovoltaic efficiencies.”

Mill Lane has been renamed Veeco Solar Equipment Inc., and will be managed by Piero Sferlazzo, Ph.D., Senior Vice President of Veeco. Dr. Sferlazzo stated, “Veeco is excited to combine Mill Lane’s web coating and vacuum engineering expertise with our existing thin film deposition technologies, such as ion beam and physical vapor deposition and thermal sources, to address the equipment needs of thin film solar manufacturers.”

Mill Lane is not currently expected to have a material impact on Veeco’s second quarter revenue guidance provided on April 28th of $102-$110 million. However, the acquisition is expected to impact previously provided Q2 earnings guidance due to the addition of Mill Lane’s operating expenses. Veeco also currently estimates that Q2 GAAP earnings will be impacted by additional amortization expense as well as a potential in-process R&D charge, both of which are currently being finalized. Taking into account all of these factors, the Company currently anticipates that the transaction will decrease its second quarter earnings per share guidance by approximately $0.05 per share on a GAAP basis, and $0.02 per share on a non-GAAP basis. Veeco currently forecasts that Mill Lane will add approximately $10-15 million in second half 2008 revenues, but is not anticipated to have a material impact on earnings.